PEAK with the new function designed to enhance efficiency.

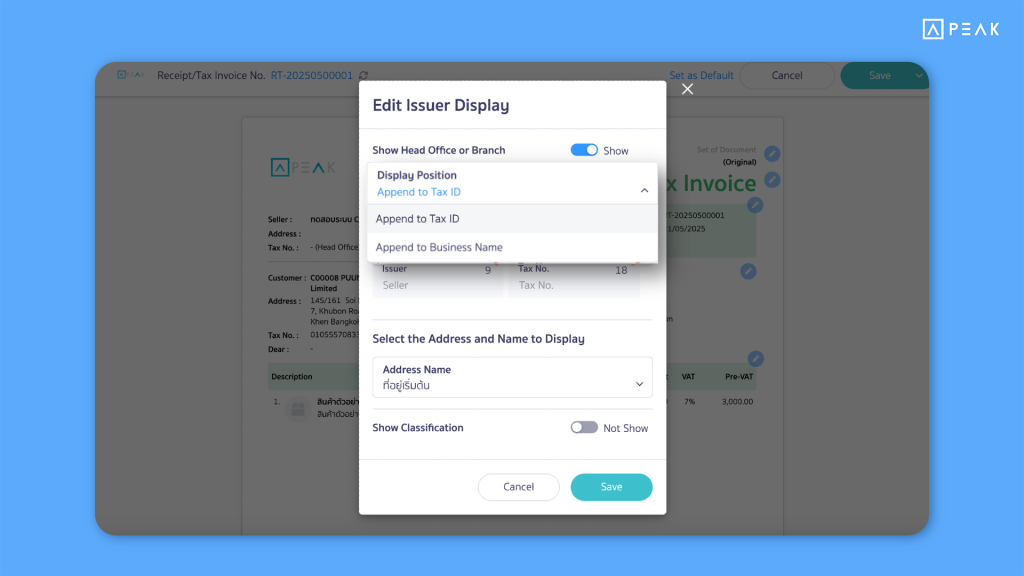

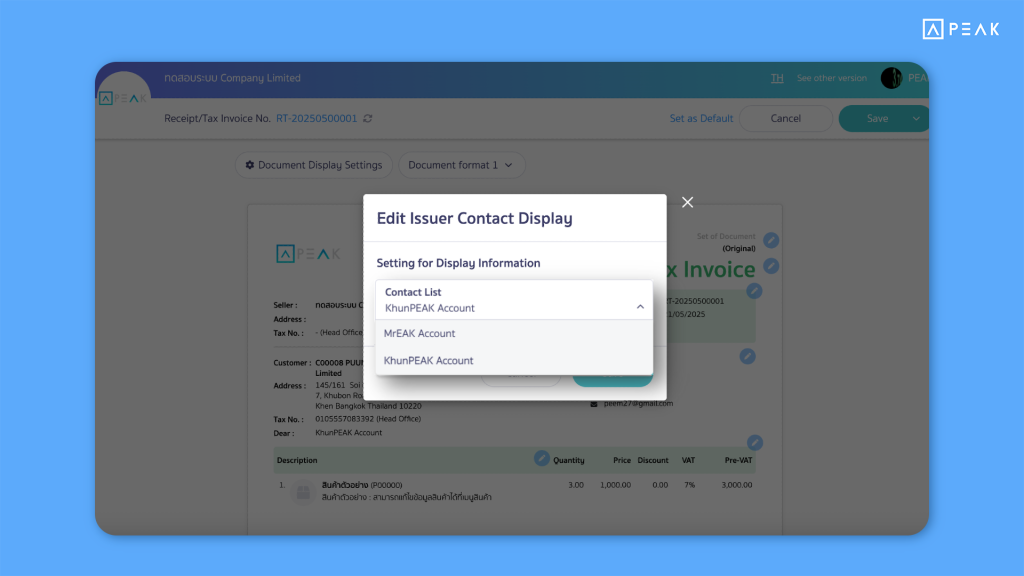

✨ 1. Add an option to display the text “Head Office” after the Tax ID number and select contact “Dear” directly from the print page.

📢 The system adds display options on the document print setting page (Online View) with the following configurations:Position of the text “Head Office”: Users can choose whether to display “Head Office” after the Tax ID or after the business name. The “Tax ID” text can also be edited.

- Change salutation from “Dear Mr./Ms.” to just “Dear”: Users can select the contact name under “Dear” directly from the Online View print page, without needing to edit the primary contact in the Contact menu.

This helps make document issuance more flexible and convenient for both formatting and displaying contact names.

✨ 2. PEAK TAX feature update makes usage even easier.

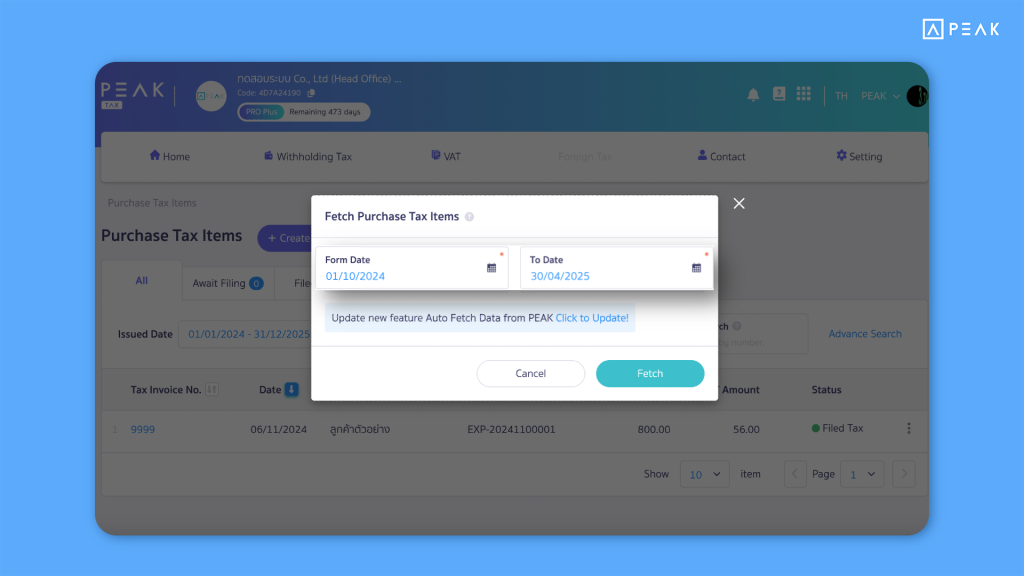

✨2.1 Default setting adjusted to pull purchase tax data from 6 months back instead of 1 month.

📢 The system adjusts the default range for the “Pull purchase tax data” button from 1 month to 6 months, covering a longer period and reducing the risk of missing purchase tax entries.

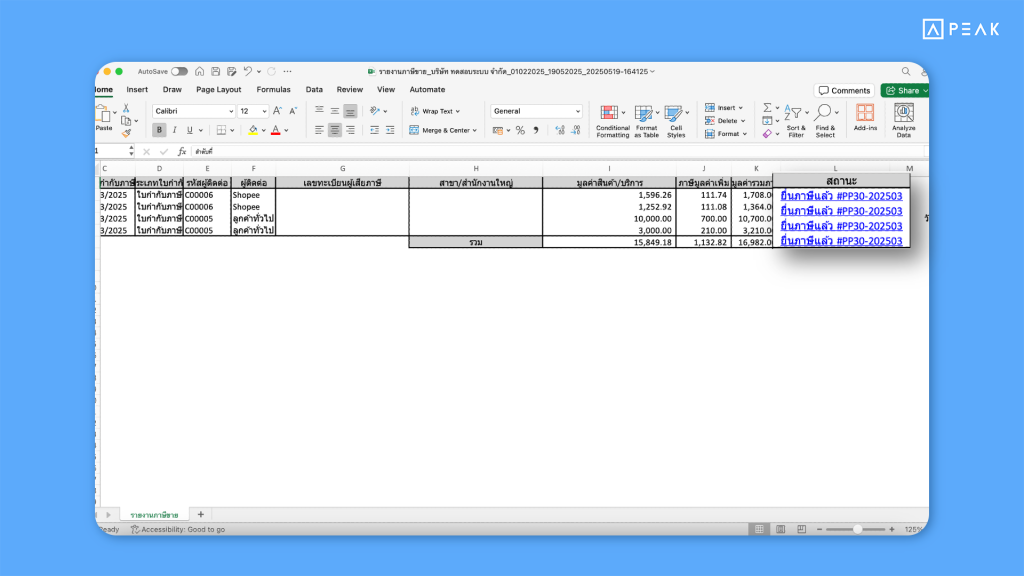

✨2.2 Add Hyperlink to Purchase-Sales Tax Report in P.P.30 form for easier access to tax forms.

📢 The system adds a hyperlink to the tax form number in the status column of the purchase-sales tax report, allowing users to click and directly view the approved P.P.30 form for easier data verification.

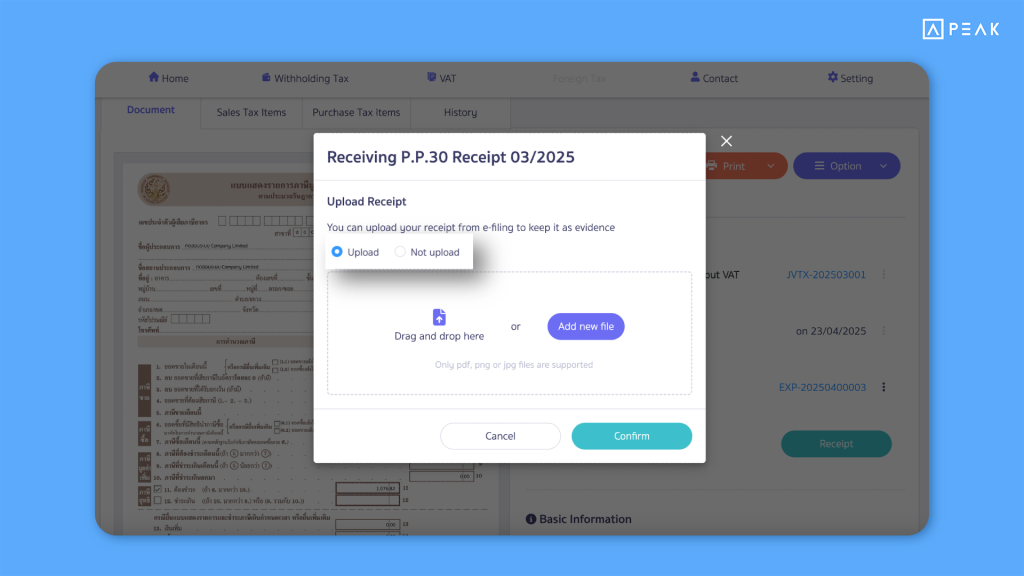

✨2.3 Add “Do not upload receipt” option on the receipt confirmation page.

📢 The system adds a “Do not upload receipt” option to the receipt confirmation page for tax forms P.N.D. 1, 2, 3, 53, and P.P.30 to better reflect real-world workflows. This option is convenient for users who do not wish to attach receipt files at this stage.

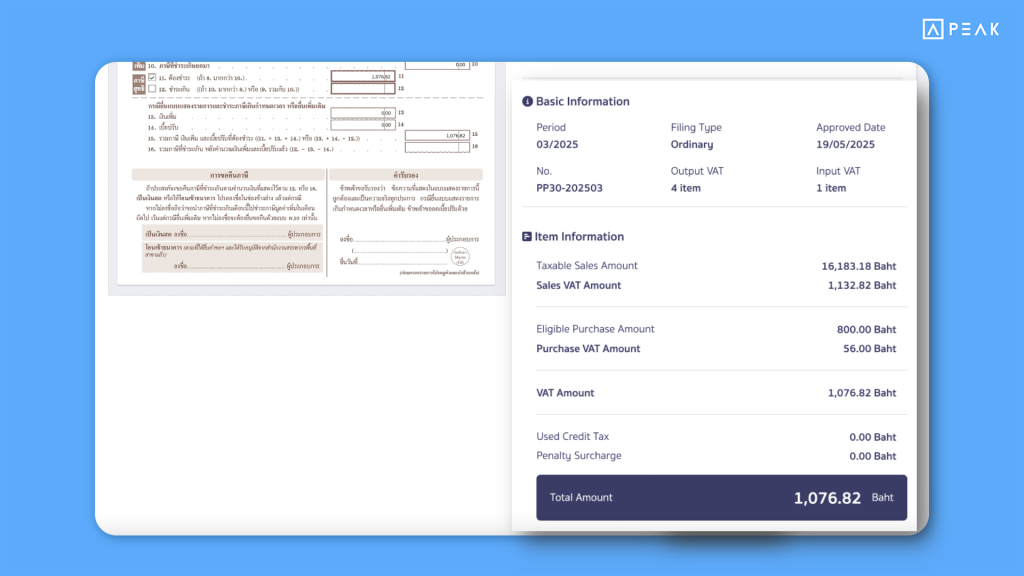

✨2.4 Display summary of sales-purchase tax used in the P.P.30 form.

📢 On the P.P.30 form page, the system now displays the sales and purchase tax amounts used in the form in the “Item Details” section, making it easier and more convenient for users to verify totals from the summary section.

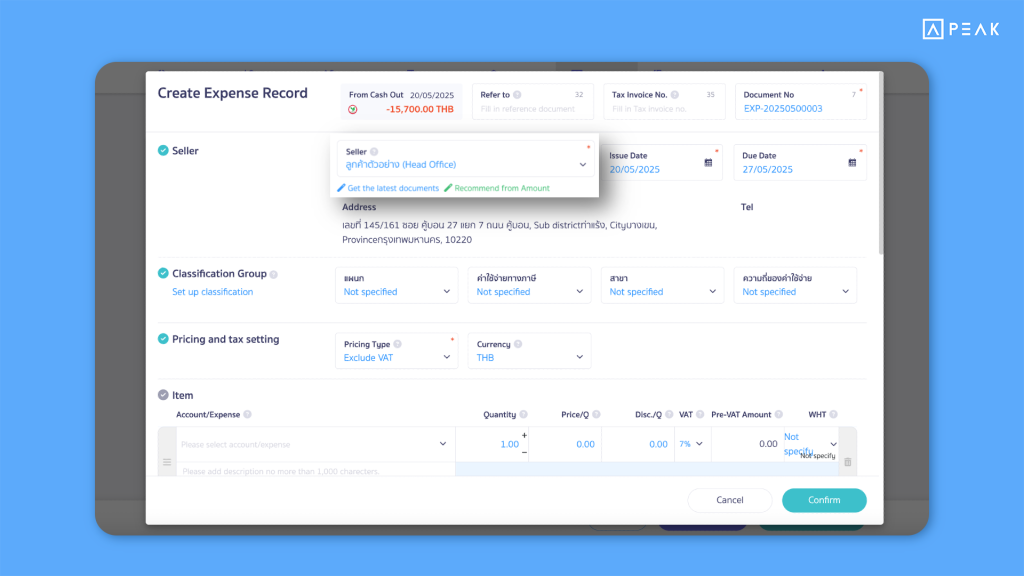

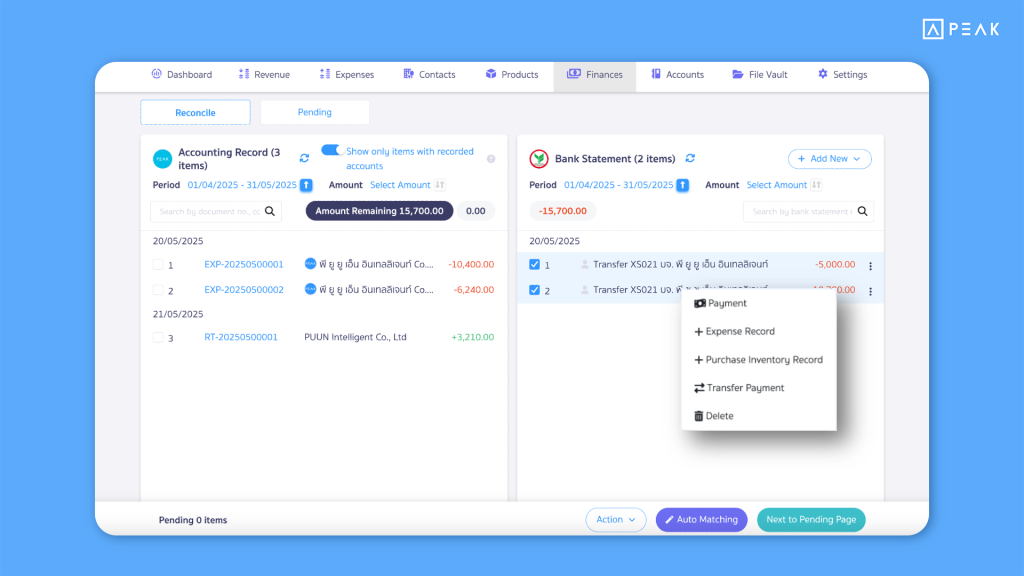

✨ 3. Manage bank reconciliation items twice as fast with AI suggestions and right-click menu access.

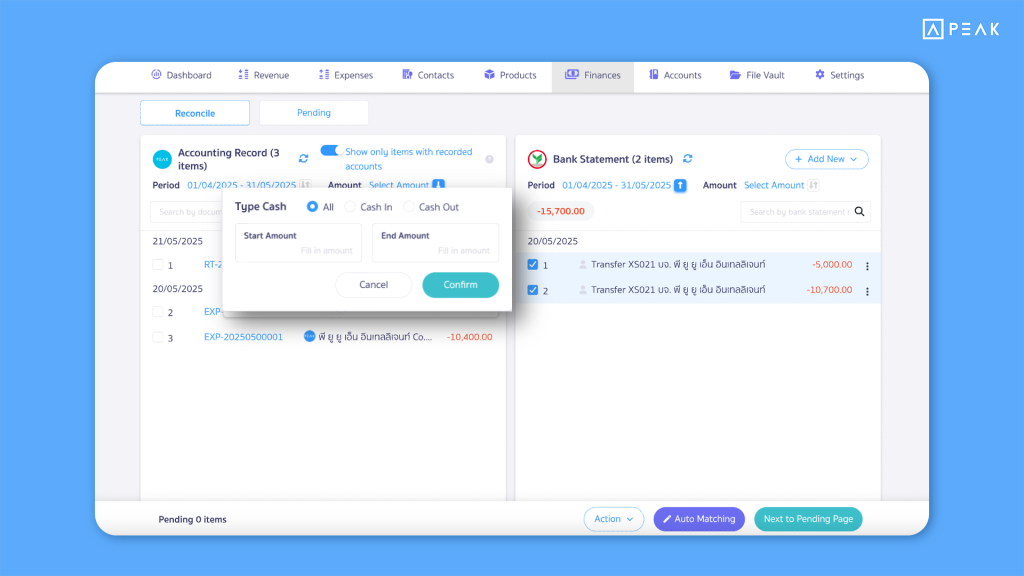

📢 For Pro Plus and higher packages, the bank reconciliation function has been updated for more convenience and accuracy as follows:

- AI suggests entries from statements: AI automatically suggests entries based on contact names in the “Notes” field of the statement and includes frequently used information such as chart of accounts, entry type, and amount—reducing manual input time.

- Right-click support on the “Record Entries” and “Reconciliation” pages for multiple items at once: Users can now right-click multiple items to quickly access commands such as Edit, Delete, Pay/Receive, or Create Document—saving time and avoiding multiple steps.

- New amount filter design: Choose to view only deposits, withdrawals, or all transactions clearly.

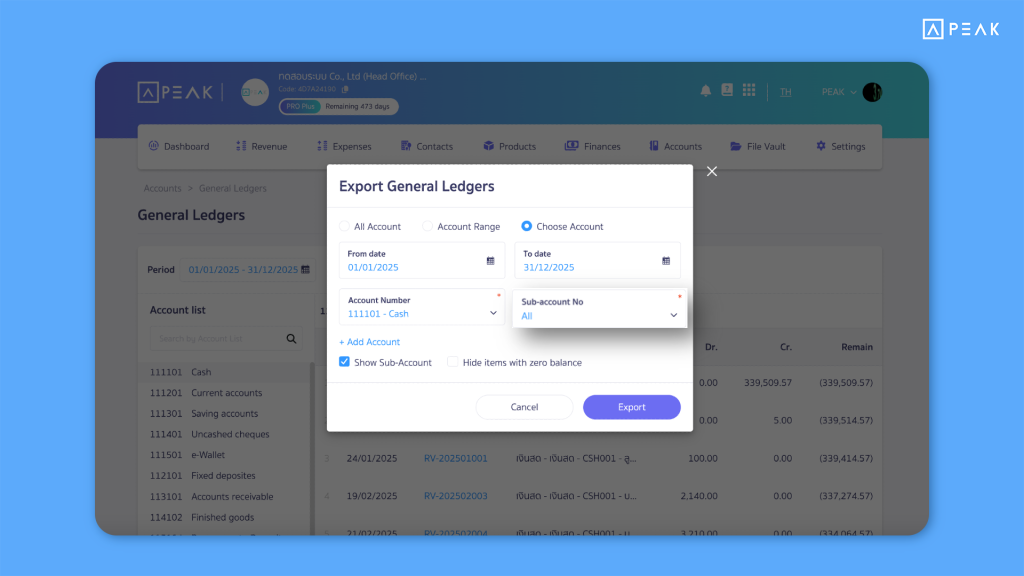

✨ 4. Adjust general ledger report print page—select “All Sub-Accounts” with a single click.

📢 When printing the general ledger report and selecting only one account, the system now shows an “All” option in the sub-account field by default. This helps prevent forgetting to select sub-accounts and ensures users can be confident their general ledger data is complete.