PEAK with the new function designed to enhance efficiency.

- Connect to TikTok Shop API! Manage orders more conveniently for online stores

- Updated Cash In–Cash Out Dashboard in the Finance menu, making it easier to view details

- Support importing Statement files from TTB Business One for bank reconciliation

- Improved document import page: edit VAT and price types in one go

- Updated accounting entries for IR and GR

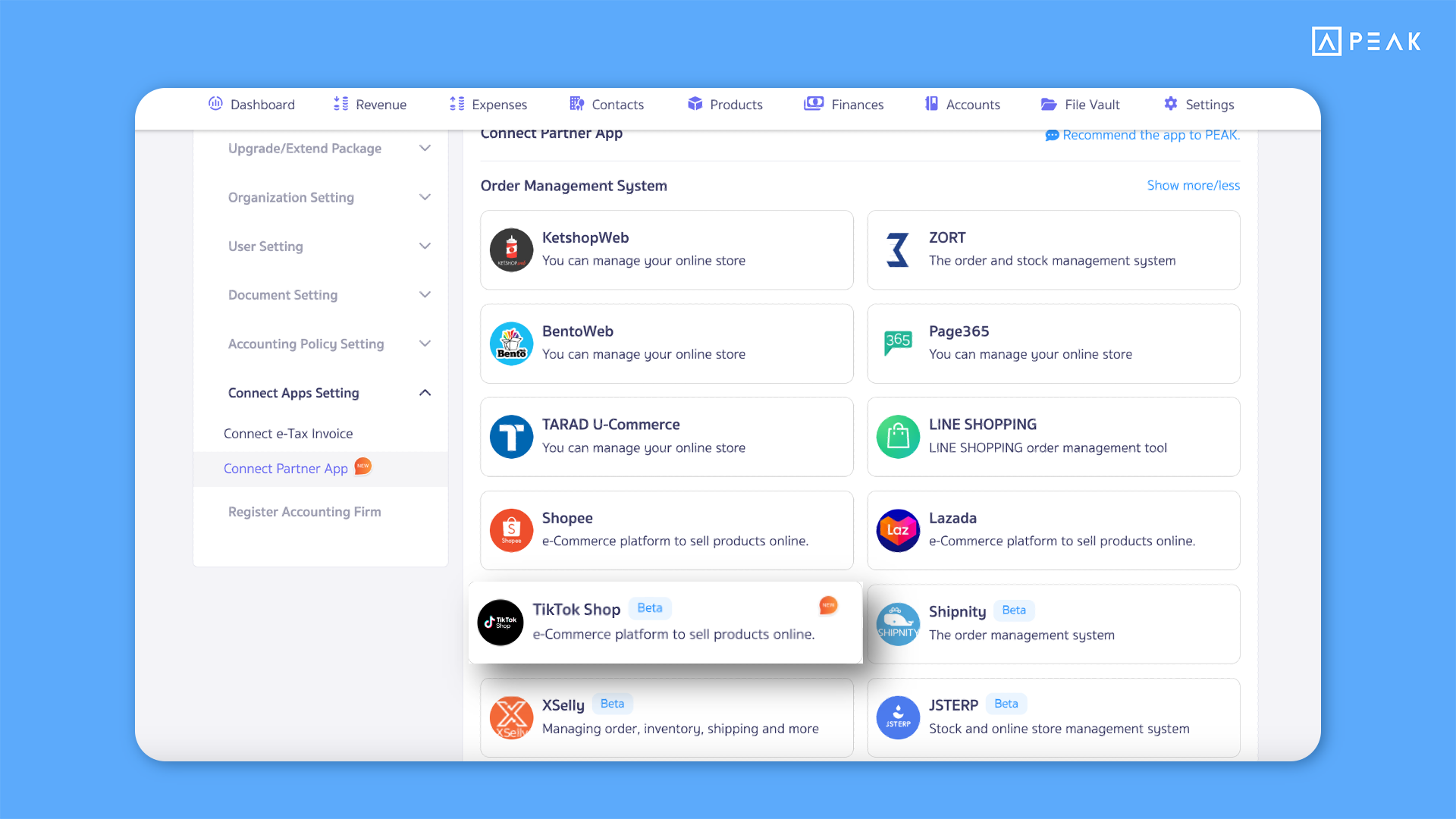

✨ 1. Connect to TikTok Shop API! Manage orders more conveniently for online stores

🧑💼 Suitable for: PRO Plus package users and above who sell products via TikTok Shop and need e-commerce API integration.

🎯 Highlight: The system now supports API connection with TikTok Shop, enabling automatic recording of sales revenue from online stores. No need to enter data manually each time, reducing work steps and making document creation more convenient.

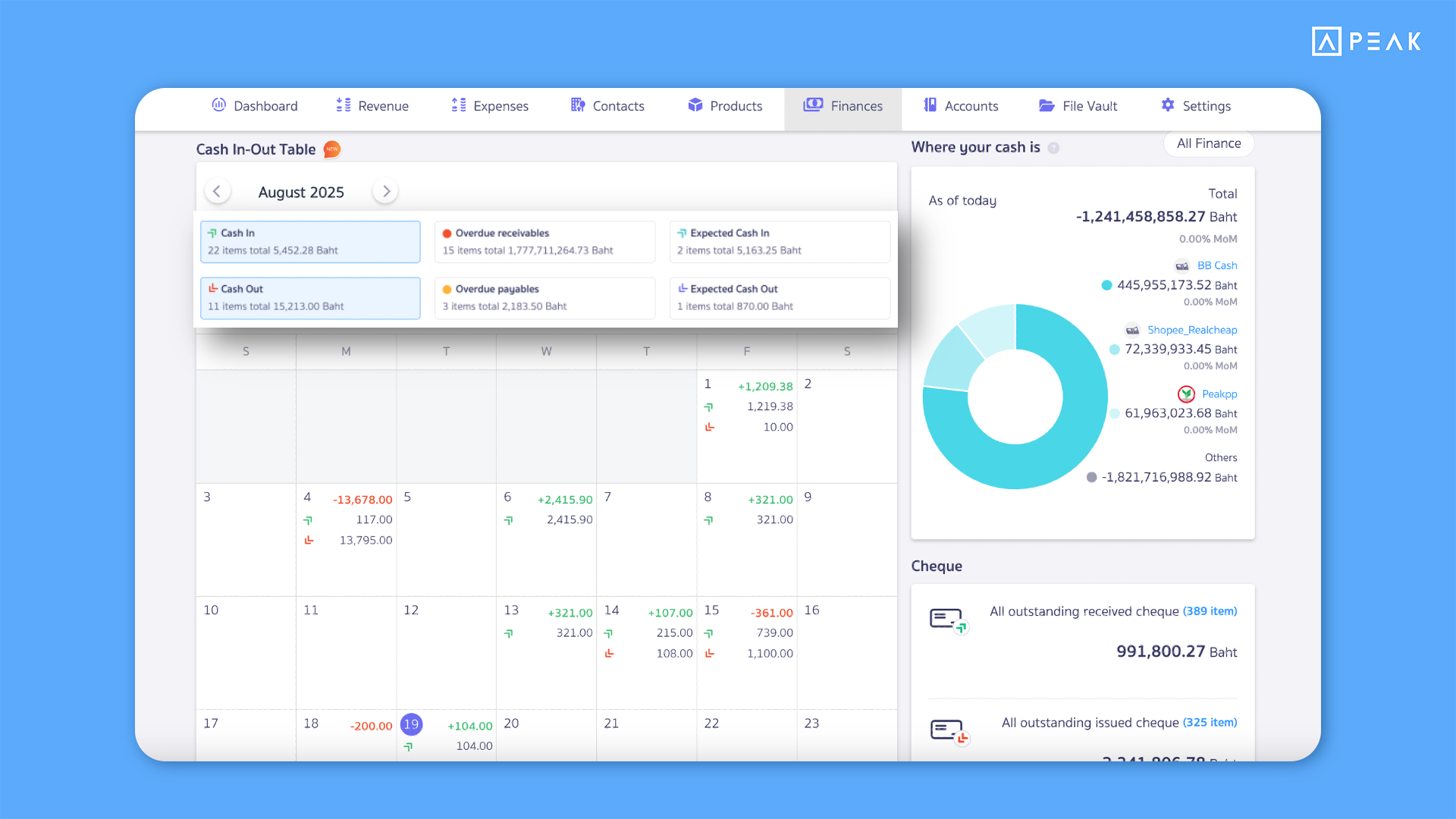

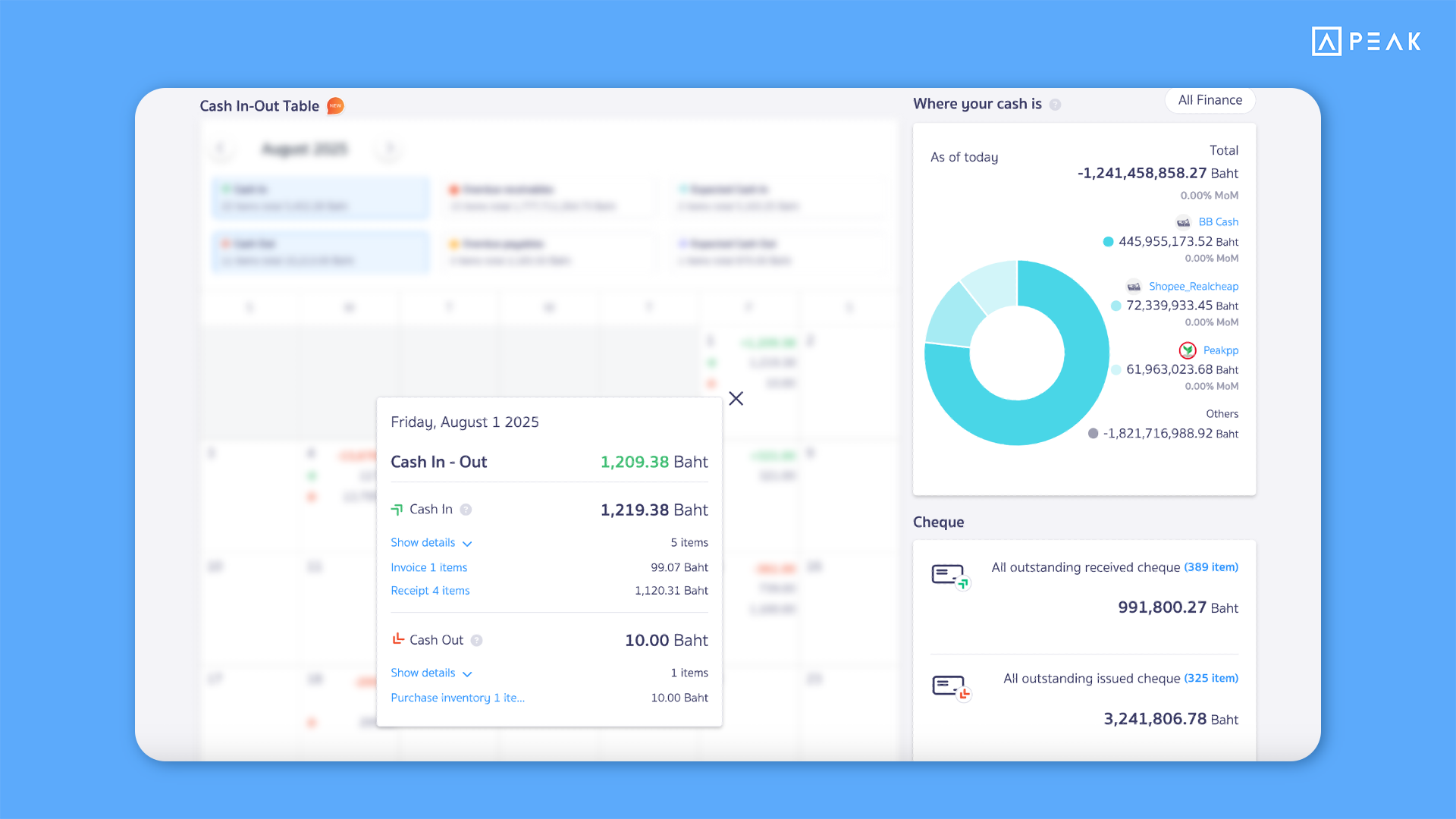

✨ 2. Updated Cash In–Cash Out Dashboard in the Finance menu, easier to view details

🧑💼 Suitable for: All users who want to monitor cash inflows and outflows quickly and in detail.

🎯 Highlight: Users can click to view detailed Cash In–Cash Out Dashboard data instantly. The sources of various amounts are clearly displayed, with information pulled directly from payment receipts on documents. Results are shown in an easy-to-read calendar format, with direct links to original documents for precise verification.

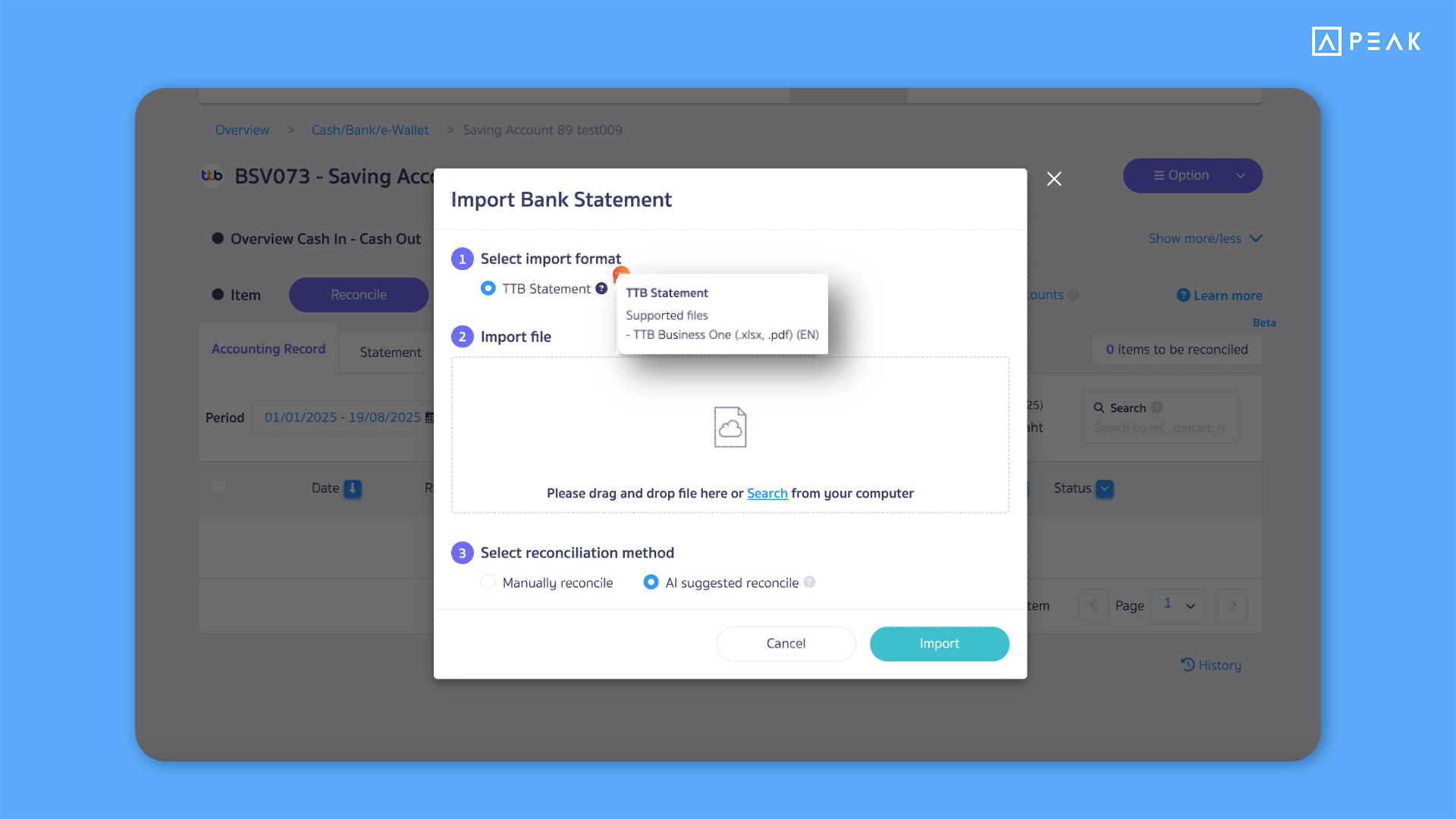

✨ 3. Support importing Statement files from TTB Business One for bank reconciliation

🧑💼 Suitable for: Accountants who need to perform bank reconciliation using TTB (TMBThanachart) Statement files.

🎯 Highlight: The system supports importing TTB Business One files in both Excel and PDF (EN version) for bank reconciliation functions, making work faster, more convenient, and more accurate.

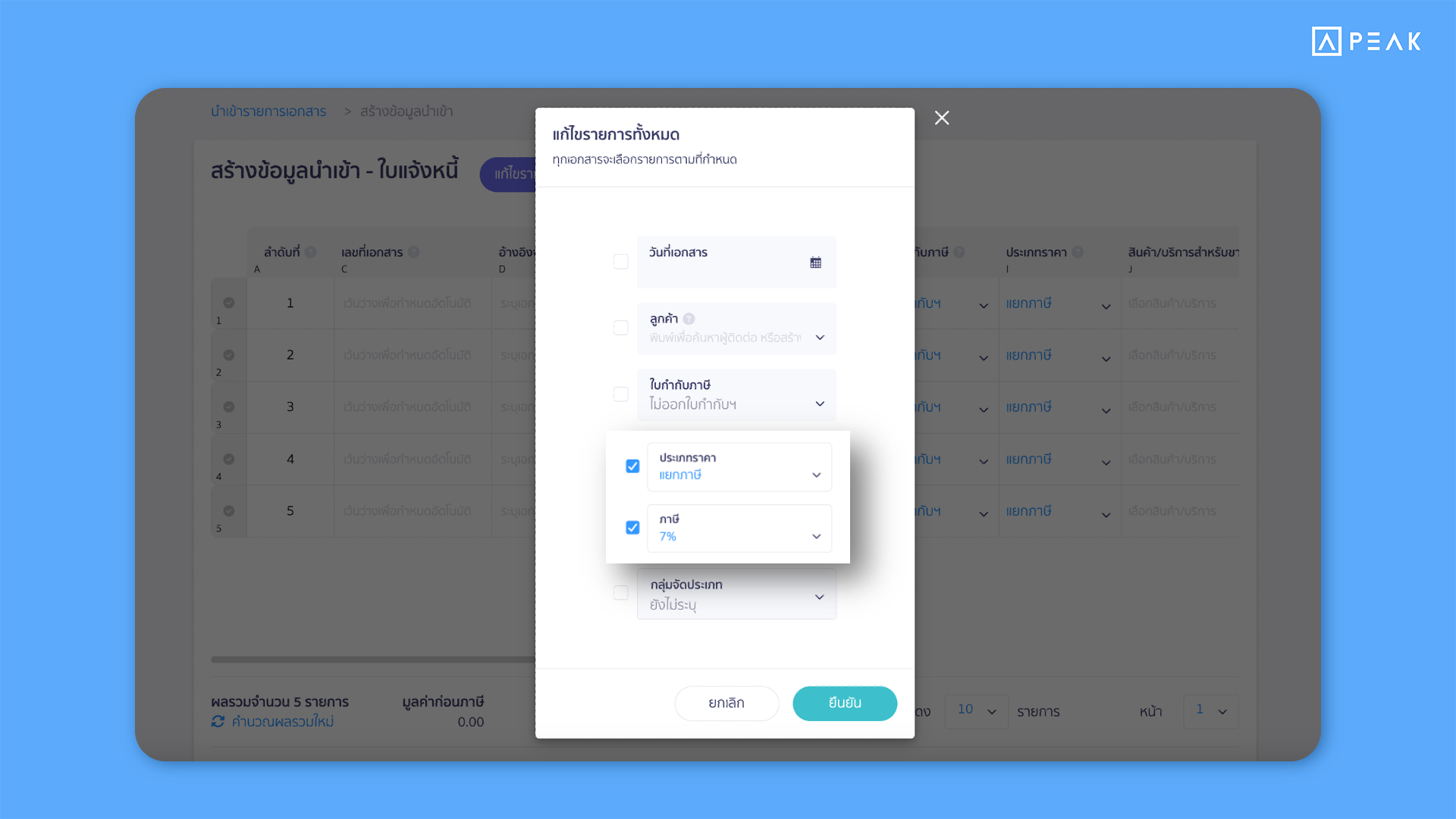

✨ 4. Improved document import page: edit VAT and price types in one go

🧑💼 Suitable for: PRO Plus package users and above who use the document import function and need to manage large data efficiently.

🎯 Highlight: When importing documents, whether from PEAK templates or other platforms, users can select the VAT type and rate for all items at once. This makes bulk data editing more convenient, saves time, and reduces errors.

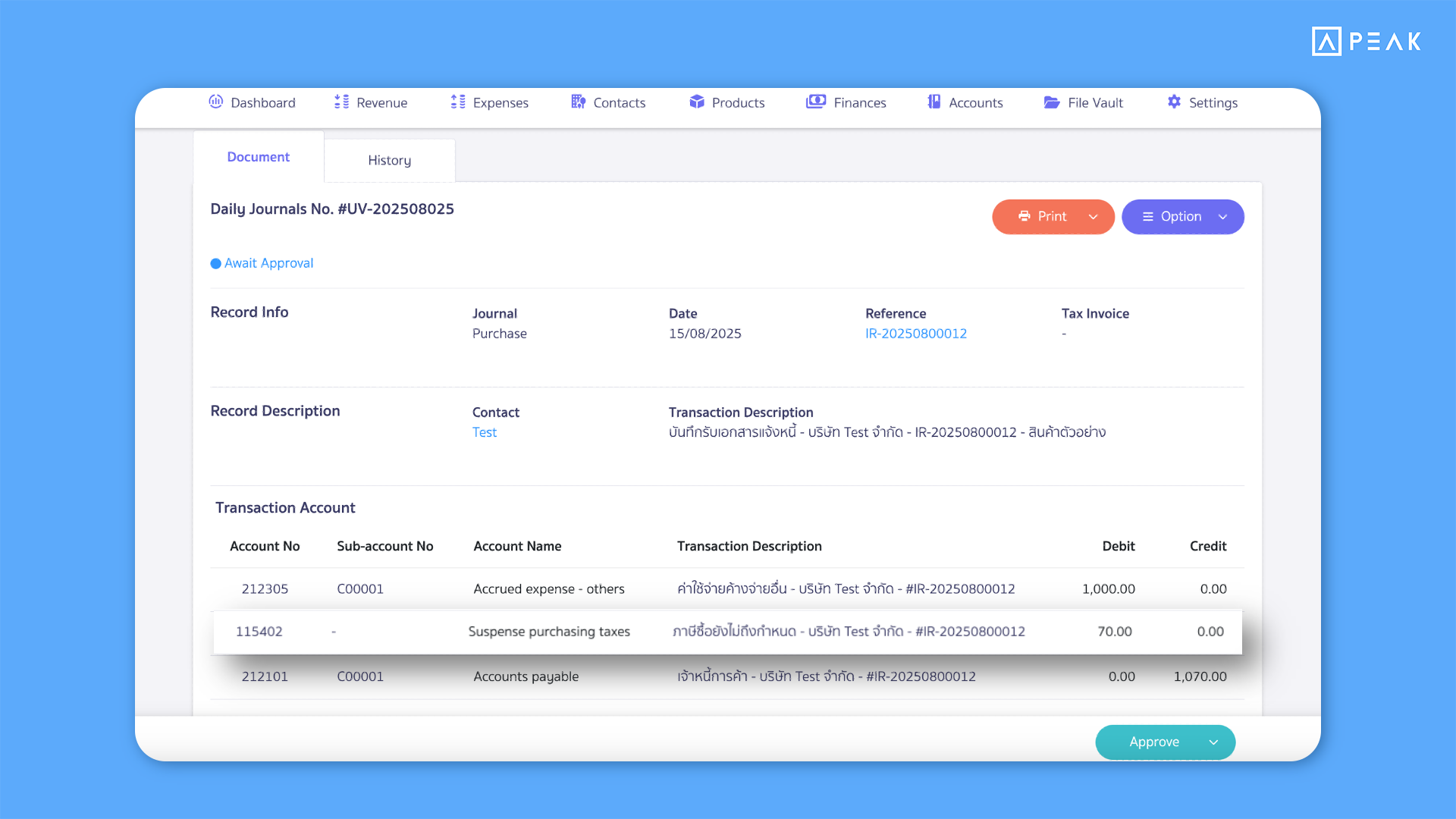

✨ 5. Updated accounting entries for IR and GR

🧑💼 Suitable for: PREMIUM package users who use IR/GR documents and review input tax

🎯 Highlight: The system has revised the accounting entries by moving the “input tax not yet due” from Goods Receipt (GR) to Invoice Receipt (IR). The GR document now only records goods and expenses, ensuring accounting accuracy and aligning with actual tax documents.

📌 Note:

- This change is not retroactive. Existing documents will not be modified unless edited or recreated.