PEAK with the new function designed to enhance efficiency.

- The system now auto-fills the 13-digit number when adding a new contact from the document creation page, reducing steps and speeding up work.

- New print window design in PEAK TAX: choose report headers and print by status immediately.

- Instantly view P.N.D. and P.P.30 form numbers from the document lock icon to make tax document checking easier.

- Changed trial balance flag color from orange to yellow for better visibility.

- Revenue, Expense, and Contact Dashboards now support “Partially Issued” and “Fully Issued” statuses for clearer document tracking.

- Add “Asset Group” directly from the asset purchase document creation page for easier data entry.

- New Refresh button added to Financial Statements for instant data updates.

- Disable editing of VAT amount in income documents to reduce data errors.

✨ 1. The system now auto-fills the 13-digit number when adding a new contact from the document creation page, reducing steps and speeding up work.

📢 For users who search for contacts by entering the 13-digit number on the income and expense document creation pages, when entering a 13-digit number into the contact field (and that number is not yet in the system), clicking the “Add Contact” button will trigger the system to automatically pull in the contact information on the contact creation page—this includes the 13-digit number, business name, and address. This helps save time when creating documents.

Example: when clicking “Add Contact”, the system will immediately pull in the 13-digit number and search for the contact.

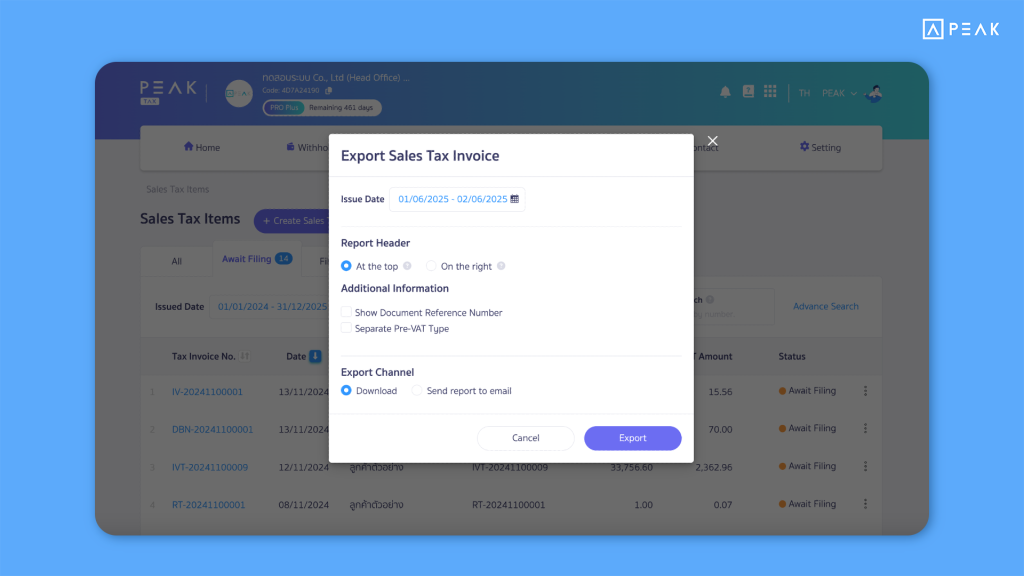

✨ 2. New print window design in PEAK TAX: choose report headers and print by status immediately.

📢 For businesses using PEAK TAX, the system has redesigned the print report window. Users can now select report headers as desired, and the system also supports printing by the currently selected status.

This helps ensure that the report output matches the display on the table screen, making printing more convenient.

Example: Sales tax invoice report with “Pending Submission” status.

✨ 3. Instantly view P.N.D. and P.P.30 form numbers from the document lock icon to make tax document checking easier.

📢 For businesses using PEAK TAX, users can now see the P.N.D. and P.P.30 form numbers of income–expense documents by simply hovering the mouse over the “lock icon” on the document page. The system will automatically display the tax form number that the document was used to submit, reducing the need to go print reports in PEAK TAX and saving time when verifying documents.

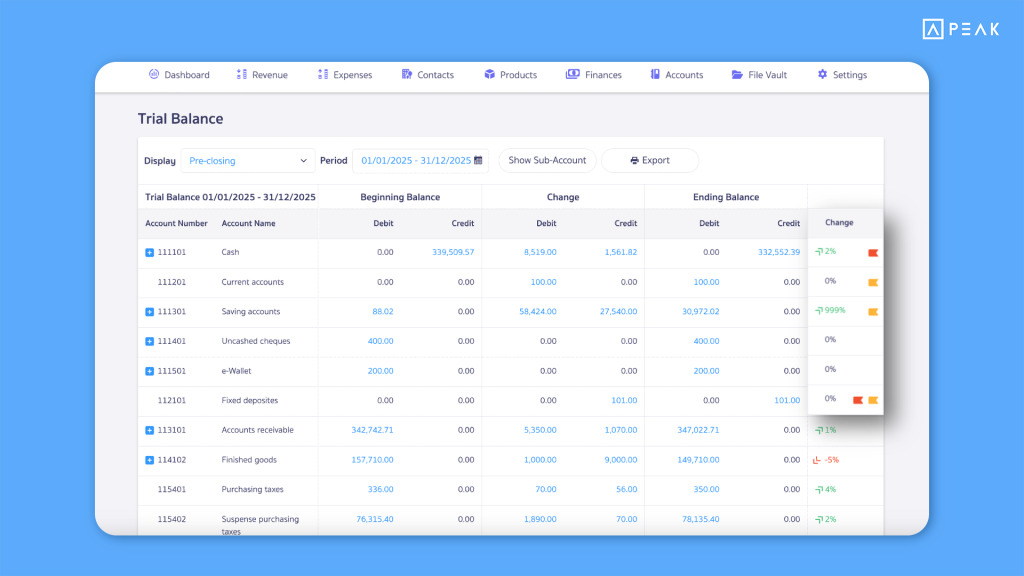

✨ 4. Changed trial balance flag color from orange to yellow for better visibility.

📢 For users who work with trial balances and need clear visibility when reviewing each entry, the system now changes the flag color in the trial balance from orange to yellow to make it easier to see and distinguish statuses more clearly.

✨ 5. Revenue, Expense, and Contact Dashboards now support “Partially Issued” and “Fully Issued” statuses for clearer document tracking.

📢 The Dashboard now displays new statuses for Quotations (QO) and Purchase Orders (PO) as follows:

- In the Revenue and Expense menus, under “Issued Documents,” the system adds new statuses: “Partially Issued” and “Fully Issued” to show the value per status when documents are created from a QO or PO.

In individual Contact Dashboards, users will see the overview bar showing revenue and expense data, making it easier to visualize document issuance.

✨ 6. Add “Asset Group” directly from the asset purchase document creation page for easier data entry.

📢 Users can now add a new asset group directly from the asset purchase document page without having to go into the PEAK Asset feature. After clicking “Add Asset Group” and filling out the details, the system will automatically save the asset group to PEAK Asset and select it for use in the document. This saves time and reduces steps in document creation.

✨ 7. New Refresh button added to Financial Statements for instant data updates.

📢 For accountants, the system adds a Refresh button to all three financial statement reports:

- Statement of Financial Position

- Income Statement

- Cash Flow Statement

This allows accountants to pull the latest data instantly without needing to refresh the entire page, keeping work smooth and uninterrupted.

✨ 8. Disable editing of VAT amount in income documents to reduce data errors.

📢 The system has disabled the edit button for VAT amounts in all income-side documents to prevent errors from manual tax calculation changes.